Running and healthy and growing organization isn’t easy. There are many moving parts that contribute to business health and they need to work in unison. Accounting, unfortunately, is often seen as a necessary evil rather than a contributor to growth. But the truth is, solid accounting provides you with the data you need to run the business, and good accounting software makes that data more timely, more accurate, and more actionable.

The Evolution of Accounting Software

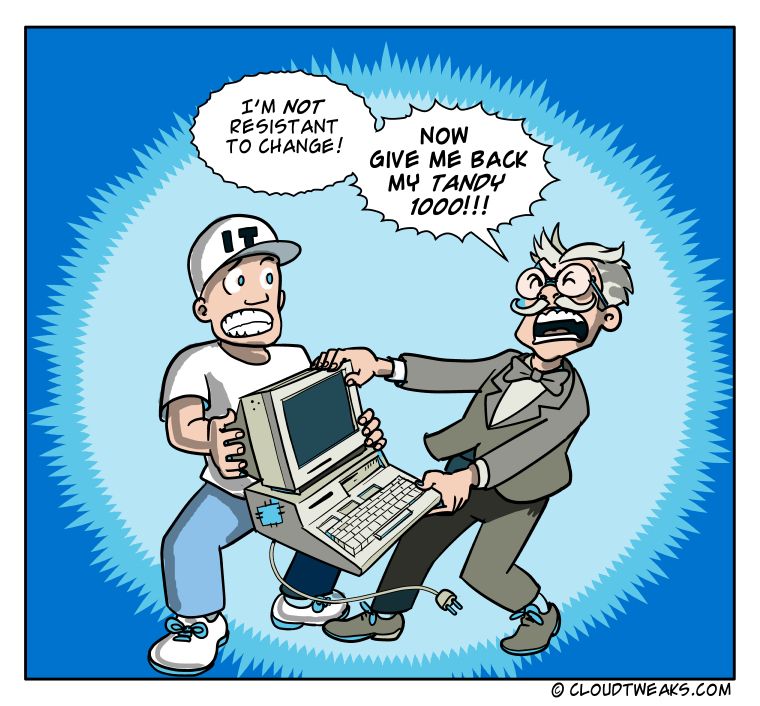

In the past, everything in the accounting department was done on paper (with special sleeve garters to keep ink off their cuffs, if you go back far enough). Paper accounting was very time-consuming and prone to simple errors, with no way to confirm accuracy but to skim every number and run manual calculations.

In the 80s, paper gave way to Excel. With spreadsheets, accountants could do the work much faster, even using formulas and macros to do complex calculations and verify the accuracy of numbers in the sheet. And while Excel was a lifesaver (and many accountants still use it for some things) it still didn’t offer the utility accounting teams needed. Today’s account software allows accountants to do much more than crunch numbers in spreadsheets. It allows them to handle the numbers faster and visualize and project what those numbers represent, making the accounting team a critical and strategic part of the organization.

Core Accounting Software

Accounting software comes in two major categories: core accounting systems and specialized software tools. Foundation systems also come in two categories: accounting-specific software and ERP systems.

Smaller organizations (or those with simple structures) often use an accounting-specific tool like QuickBooks or Xero. These options give you everything you need to manage your chart of accounts and can sync with apps designed for specific purposes like AR, AP, or inventory management. ERP systems like NetSuite and Sage Intacct have modules to help you manage all aspects of your business, including accounting, inventory and supply chain management, HR, and CRM. For a larger or more complex business, ERPs help you keep everything connected and accessible.

Specialized Accounting Software

While accounting software and ERPs cover the basics for any business, every company is unique and needs to manage specific tasks. Specialized accounting software connects to your core system and helps you solve a specific problem. Some examples of specialized software are FloQast for monthly close management, Planful for financial planning and analysis, and Workiva for reporting. Depending on the size of your business, the industry, and whether you’re public or privately held, you’ll need different tools to meet your needs. Specialized software lets you customize your tech stack to fit your business.

How Accounting Software Helps Improve Performance and Grow Revenue

So, now that you have the modern accounting software that suits your specific business, how does it help you grow that business and run it better? Accounting is like an ongoing physical exam, and the data your accounting processes provide are like vital signs. To make profitable business decisions, you need access to the right numbers at the right time, and that’s what accounting software provides.

Here are three examples of how accounting software help to improve organizational performance:

Making KPIs Easy to Track

With the right accounting software, you can easily customize reports and dashboards to show you exactly the key performance indicators you need to track in your business. These reports can be set to run automatically and can easily be shared and sent to key stakeholders who need easy access to that information without needing to dig into the books to find it. This is crucial for good decision making and making it easy makes it much more likely the information will actually be used.

Identifying Errors Faster

Monthly tasks like closing the books and reconciling accounts can take days, but close management software can shorten the process considerably, allowing the accounting team to focus on more strategic things. By ensuring that accounts are reconciled every single month, you’ll catch errors faster so you can correct them and always work with accurate data.

Smarter Forecasting

Today’s accounting software uses AI to supercharge the forecasting process. You can easily create accurate forecasts of both your revenue and cash flow based on historical data, which makes it much easier to budget and plan going forward. Once you have a budget and a plan, your software can also make it much easier to stick to it, by giving you a ton of visibility on your actual spending and alerting you to any areas that are going over budget.

Trends for why companies need Close Management in 2023

1. In a post-pandemic world, remote work is here to stay. When the entire accounting team was together in the same location for at least 40 hours / week, managing the close process the old-fashioned way had a chance to work. A shared spreadsheet, regular huddles, yelling over the cubicle wall, or hunting someone down in the break room was inefficient, but it was familiar and felt like collaboration, however inefficient.

In 2022 and beyond, physical presence among team members is much less consistent, everyone is distracted on Zoom, the volume of email and noise on Slack is overwhelming, yelling over the wall concerns the neighbors, and hunting someone down at their house really freaks out your colleagues. In short, the old methods are no longer feasible. As a result, strategic, forward-thinking companies will provide the tools necessary for the accounting team to collaborate effectively to accelerate the monthly close process.

2. In a tight labor market, employee satisfaction and engagement are extra important. Employee satisfaction and engagement are always important, but in an environment of increasing employment options, it’s critical that companies do all that they can to provide meaningful and strategic work. The more employees think, “There has got to be a better way!”, in the course of their average work day, the more they’ll be inclined to pair that thought with, “There has got to be a better company to work for where I can make good use of my time, learn valuable new skills, and add more value to a worthwhile cause.”

In reverse, the more that employees see their employer investing strategically to elevate their role and maximize their time, the less likely they are to search for greener pastures. The best leaders will recognize that they’ll increase their chances to retain their most valued employees not just with competitive wages and benefits, but by eliminating a manual, soul-sucking, weekend-killing monthly-close process.

3. In an uncertain economy, controlling what you can is a great start. Things are getting crazy out there – from global inflation to rising interest rates to an uncertain geopolitical climate. And the ability for any one company to even influence those types of challenges is something close to absolute zero. That’s why it’s essential for companies to control what they can – implementing month-end close automation technology and accompanying procedures that promote compliance and trust. Committing to and delivering a prompt, efficient, and thorough monthly close process facilitates so many good things:

a) Trust increases in every direction as financial results are timely and accurately released

b) The accounting department is freed up to answer not just the “what”, but to analyze the more important “why” questions

c) Executives and key stakeholders are able to make better, faster, data-driven decisions to secure a profitable future for the organization

d) Auditors are happy and efficient as they have the information they need at their fingertips

Ending Balance

To get the most out of your accounting department, companies would be wise to bring their controller or accounting manager into key strategic meetings to discuss what data is needed and how to get it into the hands of decision-makers at just the right time.

As each new generation of accounting software gets smarter, accounting teams can play a bigger role in impacting organizational performance and profitability. The faster and more accurately an accounting team can generate data, the more informed company decisions become, which leads to better financial outcomes for the entire organization.

By Mike Whitmire

Mike Whitmire, CPA*, is CEO and Co-founder of FloQast, a provider of accounting workflow automation software created by accountants for accountants to help them work smarter, not harder. Before founding FloQast, Mike began his career in audit at Ernst & Young, focusing on media and entertainment, before joining the accounting and finance team at Cornerstone OnDemand as the company prepared for its IPO. During his time at Cornerstone OnDemand, Mike first developed the idea for what would be FloQast.

In July 2021, FloQast raised $110 million Series D at a $1.2 billion valuation. Today, it has more than 400 employees worldwide. In January, FloQast released PBC, a comedy series written and developed by FloQast employees, including Mike, based loosely on his experiences as an auditor.

A proud Angeleno, Mike is a big Los Angeles Dodgers fan and an avid baseball card collector. He resides in LA with his wife and daughter.

Originally posted on November 9, 2022 @ 11:59 pm

![Read more about the article What Is FTX & Who Is Sam Bankman-Fried? [The FTX Scandal]](https://sonicsurfisp.com/wp-content/uploads/2023/01/what-is-ftx-who-is-sam-bankman-fried-the-ftx-scandal-300x180.png)