Open Access

The company’s CEO said he expects states to set BEAD terms favorable to open access builds.

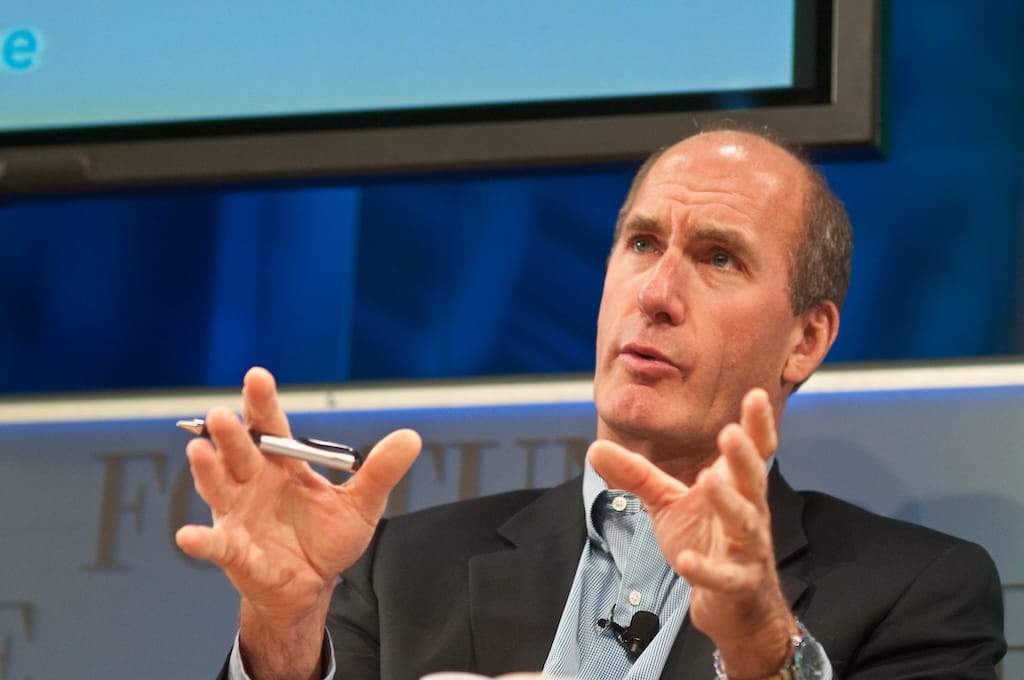

Photo of AT&T CEO John Stankey by Kevin Moloney used with permission

Photo of AT&T CEO John Stankey by Kevin Moloney used with permission

May 21, 2024 – AT&T is expecting open access broadband networks to proliferate in the coming years, the company’s top executive said on Tuesday.

“I think we’re going to continue to see more open access networks show up in the United States,” AT&T CEO John Stankey said at a J.P. Morgan conference in Boston.

The company has already made a bet on the open access approach, which involves allowing multiple ISPs to provide service on the same physical infrastructure. In 2022, AT&T joined investment firm BlackRock in an open access joint venture called Gigapower. The companies are aiming to pass 1.5 million homes and businesses with a new fiber network on which AT&T will be the anchor tenant.

Gigapower executives have signaled that the joint venture is aiming to scoop up some grant money from the $42.5 billion Broadband Equity, Access and Deployment (BEAD) program, the Biden administration’s major broadband expansion effort. Stankey said he thinks the program will be favorable to the open access model in certain states, which get to set their own terms for awarding grants under BEAD.

“I think there will be some states under the BEAD structure that are probably going to have conditions or expectations that the government subsidized portion of those networks may need to be built with an open access condition on it,” he said. “I don’t think that will be universal, but I think it will pop up in certain places.”

The seven states with fully approved BEAD plans haven’t included such provisions so far, although Washington will give higher scores to grant applicants looking to build open access projects. West Virginia removed a similar scoring criteria from its plan after hearing public comments.

For its part, Frontier Communications is looking to stick with the traditional model for its expanding fiber networks and isn’t worried about open-access competitors impacting its footprint, the company board’s executive chairman John Stratton said yesterday at the J.P. Morgan conference.“We don’t see a whole lot of that in the critical path for our business,” Stratton said.

But AT&T isn’t the only major telecom getting into open access networks. Last month, T-Mobile closed a deal to acquire Lumos’s fiber network and transition it to an open access model. Like AT&T on Gigapower, T-Mobile will be the network’s anchor tenant.

Stankey said he sees the open access model helping the company gain a foothold in new markets, either by owning the infrastructure and leasing to tenant providers or operating as a tenant itself.

“If there’s a way I can go and offload risk in markets that I may not be as successful in, and I have a partner who’s willing to take on some of that risk, I want to do that,” he said. “If there’s another open-access provider out there who wants to build the base infrastructure and get into a collaborative marketing partnership that allows me to bring my wireless service at the top of it… I want to sign a deal like that.”